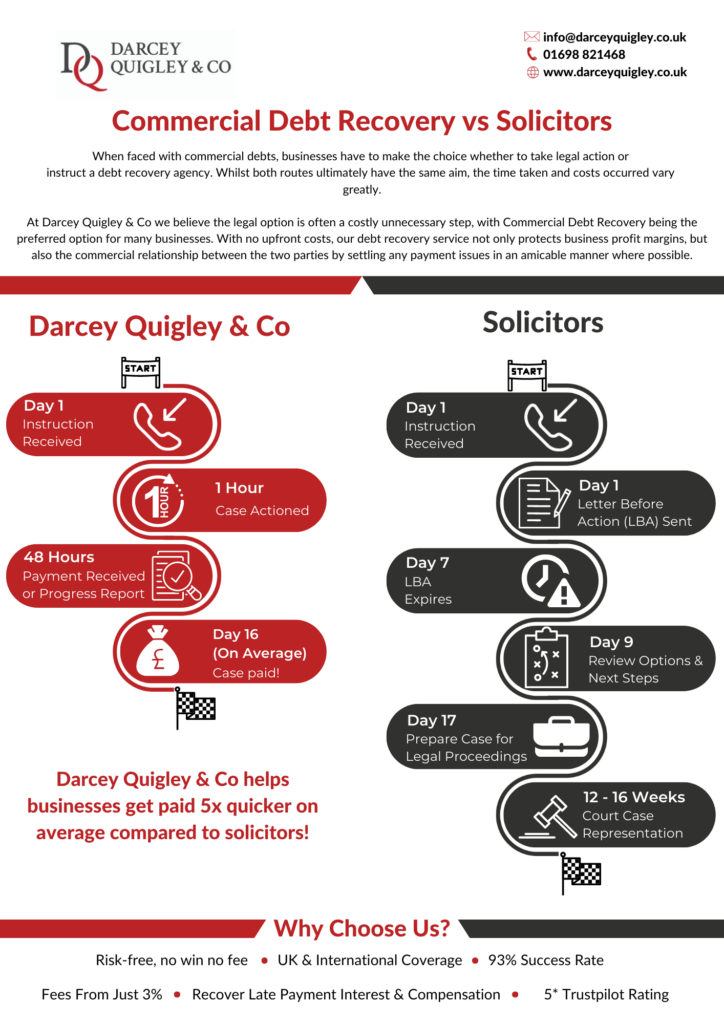

How Our Process Is 5x Quicker Than Using A Solicitor

The commercial debt recovery process might sound complicated and even daunting if you have never used a debt recovery partner to help you recover commercial debt.

We understand this and our simple process is what makes Darcey Quigley & Co’s approach to debt recovery different.

The commercial debt recovery process doesn’t need to be difficult to follow. In fact, it should be as quick, simple and straight forward as possible.

Many businesses who are encountering overdue invoices for the first time assume their only option is to turn to a solicitor.

However, getting in touch with a debt recovery agency is often far more efficient in terms of time and cost.

When you have unpaid commercial invoices, the lack of clarity and time you have can make the situation immensely difficult.

This is why we have developed our simple process where we action your case within one hour and help get you paid quicker, putting the situation at ease.

In fact, our process ensures businesses are paid on average 5x quicker compared to using a solicitor to recover commercial debts!

Our step-by-step process to commercial debt recovery

Darcey Quigley & Co’s simple commercial debt recovery process can be broken down into just 7 steps.

1. Initial discussion

The very first thing we do is find out more about your business, your late paying customer and outstanding commercial debt.

This is where we cover all basis and gather as much information as possible to help build your case and plan the best course of action for collecting your commercial debt as quickly as possible and reduce your debtor days.

2. Documentation

Once we are ready with our plan of action to collect your overdue invoices it is time to compile all necessary documents to back up your case.

Your Invoices and any other communications between you and your late paying customer are what we need at this point. The more information you can provide the better your case will be.

3. Forensic investigation

Using our team of commercial debt and credit management experts we conduct a thorough analysis of your late payer including business credit checks, company name checks and risk assessments.

Being UK market leaders in commercial debt recovery we’ve encountered the same debtors numerous times.

4. Agree fees & approach

Our fees start from 3% and are dependent on the age of the oldest invoice, the country your debtor operates in, their trading status and the invoice value.

All these factors will also dictate the approach we take to recover your outstanding debt.

5. Action within 1 Hour

Once we reach an agreement with you, we will action your case within the hour.

6. 48 hour turnaround

Communication is key to our recovery process, and we always seek to give you as much clarity and insight as possible keeping you up to date with all developments.

You can expect a full case report or payment within 48 hours of instruction.

7. Payment

On average we recover commercial debts within 16 days of instruction.

In some cases it takes just 1 phone call. Our name, reputation and the power of outsourcing commercial debt recovery is why we are so successful.

Darcey Quigley & Co’s debt recovery process vs solicitors

An alternative method of collecting outstanding commercial debt would be to go through a solicitor.

Whether you use a debt recovery partner or a solicitor you ultimately want your late invoices paid as quickly as possible.

This is where there are major flaws in using a solicitor to recover outstanding debt.

Time

When you have outstanding commercial debt time is of the essence. Your aim is to get paid as quickly as possible.

This presents a huge issue when you go down the legal route and get a solicitor involved in collecting your outstanding debt.

Using a solicitor means you could be waiting at least 3 months before a court case representation.

Here at Darcey Quigley & Co the average case is paid out within 16 days of the case being actioned!

Cost

Using a solicitor for debt recovery is significantly more expensive than using Darcey Quigley & Co for a few reasons:

Solicitor cases are very time consuming, and costs are charged at the solicitor’s hourly rate.

Legal fees are very costly.

Darcey Quigley & Co have no up-front costs.

With Darcey Quigley & Co you only pay a percentage of the debt as your fee to us. If we can’t recover your debt you don’t pay a penny.

Another key aspect to our approach is that we do not want to jeopardise potential future business between you and your late paying customer.

We take careful steps to keep your relationship intact even when collecting monies owed.

Plus, we always endeavour to collect debt recovery costs on your behalf from your debtor which results in free commercial debt recovery!

Recovering late payment interest & compensation on top of your overdue invoices

If you have outstanding commercial debt, did you know you are legally entitled to charge interest as well as claim compensation and reasonable costs for debt recovery?

Find out exactly how much you can claim in just 30 seconds with our free calculator.

Simply answer a few quick questions about your debt and we’ll calculate exactly how much interest and compensation you can legally claim.

If you are happy to proceed you can even upload your invoices and begin your commercial debt recovery case immediately!

This is an extra step we’re taking to simplify our debt recovery process even further.

We understand that you have more important matters to attend to running your business or credit control function, so let Darcey Quigley & Co collect outstanding commercial debt and deal with your problematic late-payers.

If you have problematic late paying customers and outstanding commercial debts speak to a specialist for some free advice today. Call us on 01698 821 468 or schedule a call at a time that suits you here.

Why choose Darcey Quigley & Co

- We operate on a no win, no fee basis.

- Cases actioned within 1 hour with 48 hour turnaround.

- 93% success rate recovering overdue invoices.

- Fees starting from just 3%.

- Recover late payment interest and compensation on your behalf with an 89% success rate recovering additional charges.

- UK & International coverage.

- Rated 5 Stars on Trustpilot.

Lynne is the Founder and CEO of Darcey Quigley & Co.

She is passionate and determined to help businesses get overdue invoices paid quickly.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 17 years, Lynne has helped businesses recover commercial debts from every continent across the globe.

Connect with me on LinkedIn!