Corporate Insolvencies About To Spike

Are we in for a rude awakening?

This is certainly the view of Deloitte in a recent article they published looking at the outlook for corporate insolvencies in 2021.

The number of corporate insolvencies in England and Wales in Q2 and Q3 2020 were at historical lows, when in fact we would expect insolvencies to be far higher due to the negative impact the coronavirus and subsequent restrictions have had on the economy.

Why is this the case?

Schemes such as CBILs/CLBILs/Bounce Back Loans, furlough, rates relief and the deferral of VAT, restrictions on statutory demands, winding up petitions and the issuing of winding up orders are examples of support the UK Government have brought in to help businesses during the pandemic and these have contributed to such a reduction in corporate insolvencies during a time when we’d expect them to rise dramatically.

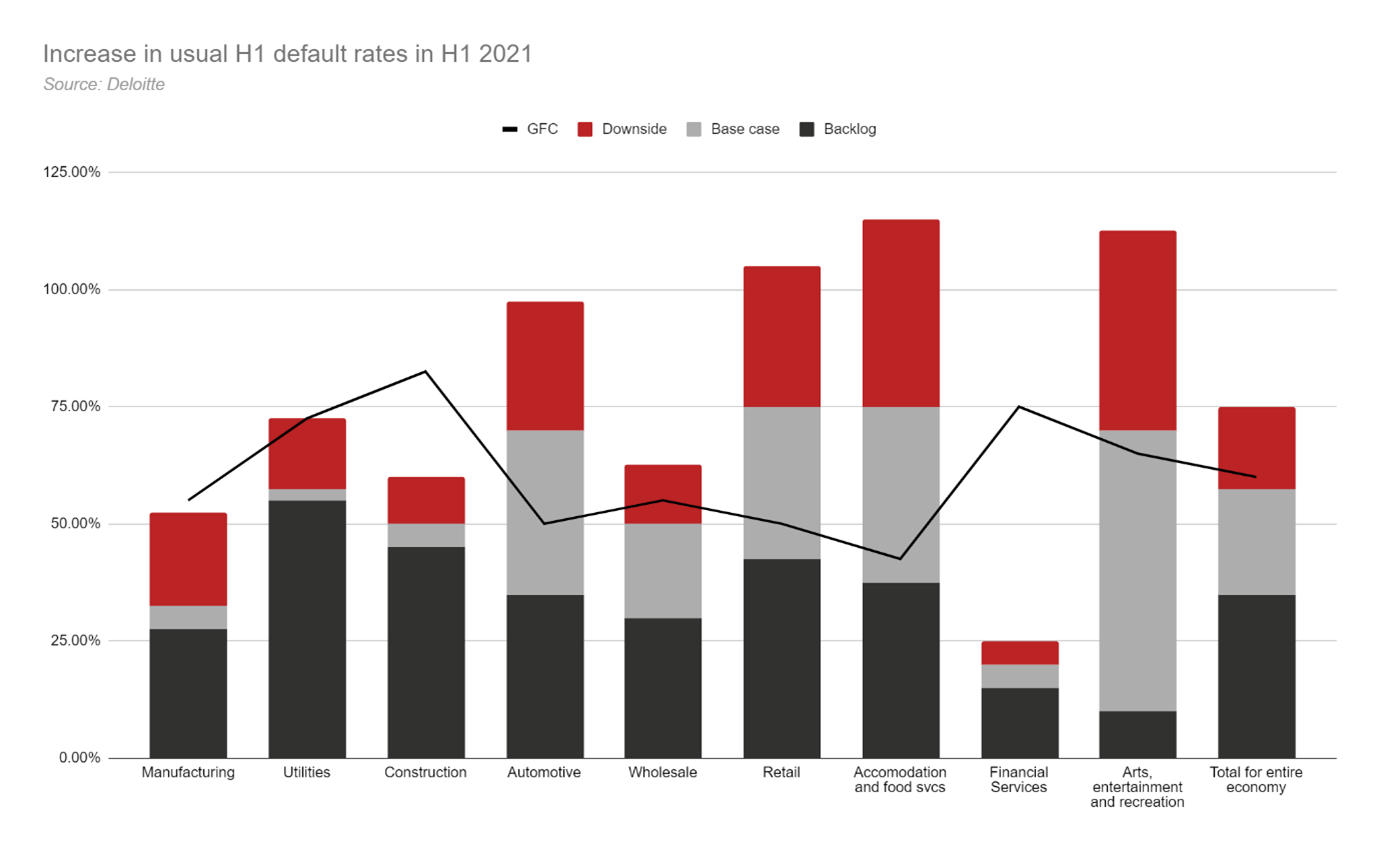

But the worst is still to come as there is currently a backlog of businesses that are on the verge of insolvency. Deloitte estimate that they could be even higher than the 60% increase in corporate insolvencies experienced in 2009 during the global financial crisis.

This is because the recent data suggests that the support from the UK Government is propping up companies who likely would have failed during normal circumstances i.e. if there was no pandemic and therefore no support on this scale from the Government.

What happens when Government support ends?

As most of the measures brought in by the Government to support businesses during the pandemic is temporary, when they are removed the number of insolvencies will spike dramatically because of two factors:

- The economic crisis we face. ONS figures show GDP shrank 9.9% last year, the biggest decline since the Great Frost of 1709 so naturally we’d expect insolvencies to rise with the economy in such poor shape.

- A backlog of “normal run-rate” insolvencies from Q2 and Q3 2020. The lower than expected numbers of insolvencies is due to the backlog of businesses who would have failed during normal circumstances had it not been for the coronavirus and support given to businesses from the UK Government.

The good news is that the support given to businesses won’t all stop at the same time, and not all industries have been impacted as much as others. Deloitte have illustrated the projected percentage increase in insolvencies for the first six months of 2021 for nine sectors as well as the total for the entire economy compared to what would have been the expected level had COVID-19 not been a factor, based on data from the previous two years to help shape the forecast.

Insolvencies from the Global Financial Crisis (“GFC”) in 2009 have also been included for comparison.

How this could affect you and how to protect your business

As we can see there are thousands of companies on the brink of insolvency. Whilst the additional help given to businesses by the UK Government to help alleviate the economic strain caused by coronavirus has been welcomed, it is keeping businesses stay alive when under normal circumstances they would have gone bust.

If you have outstanding commercial debts, you should set out a plan to collect them as soon as possible. The longer you leave outstanding debts the higher the chance that your money will be unrecoverable, and you will have lost out on the cash you’re owed.

As the UK starts to bounce back from the pandemic as we venture on the road to recovery the additional help granted to businesses to help them survive will be turned off. This is when we will see the expected spike in insolvencies and the knock-on effect this will have on creditors has the potential to be catastrophic as businesses will have lost money that they have been owed.

Recovering commercial debt via solicitors through court will take months due to the situation we find ourselves in at the moment. Pre-litigation debt recovery often avoids the need for escalation to court proceedings. The main benefit of pre-litigation services is that you get paid quicker, especially now that court cases are taking even longer, and it is often far cheaper to collect debt this way as expensive court fees are avoided.

Get help with outstanding debts

It might feel intimidating or uncomfortable to approach a third-party debt collection agency. However, if you are unable to recover your overdue invoices from late payers getting a helping hand from the experts can go a long way towards getting the job done.

Here at Darcey Quigley our team are experts in pre-litigation debt collection. We specialise in telephone commercial debt recovery and our team has over 25 years’ of expertise in the area. With a proven track record and professional approach Darcey Quigley are the UK’s most trusted debt collection agency. Get in touch with our team today to find out how we can help you recover your commercial debts.

Call us on 01698 821 468. Our debt recovery specialists are on hand to advise on the best course of action to get you paid quicker.

Lynne is the Founder and CEO of Darcey Quigley & Co.

She is passionate and determined to help businesses get overdue invoices paid quickly.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 18 years, Lynne has helped businesses recover commercial debts from every continent across the globe.

Connect with me on LinkedIn!