6 Figure Debt Against PLC Paid in 2 Days!

Amount Due: £120k

Months Overdue: 8 months

Time to Recover: 2 Days

Chasing overdue payments can be frustrating and time-consuming, especially when the debtor is a large, publicly listed company with layers of red tape and gatekeepers. Many businesses feel powerless when their invoices are ignored by major organisations, but at Darcey Quigley, we thrive in these situations.

This case study highlights how we successfully recovered a six-figure debt from a PLC within just 2 business days, showcasing our proactive approach, specialist tools, and commitment to getting results no matter the size of the debtor.

Client Background:

In this case, our client, a UK-based manufacturing company, approached Darcey Quigley after exhausting internal resources to collect a substantial overdue debt. The outstanding balance, owed by a large publicly listed company (PLC), was placing significant strain on the client’s cash flow and operational stability.

Challenge:

The debtor, an established PLC had repeatedly failed to respond to payment requests or provide updates on the status of the invoice. As a large organisation, it proved difficult for the client to reach the right decision-makers. Traditional communication channels were proving ineffective, and the client feared the debt would remain unpaid indefinitely.

After exhausting their options and facing obstacles they couldn’t get over themselves, the client decided it was time to outsource the debt recovery to Darcey Quigley & Co.

Solution:

Darcey Quigley took immediate action upon instruction. Leveraging our specialist commercial debt recovery tools, we conducted a thorough investigation into the PLC’s corporate structure and contact hierarchy. Using advanced data sources and proprietary systems, we were able to identify multiple key contacts.

This strategic insight allowed us to escalate the matter swiftly, ensuring that the right individuals were made aware of the situation and the urgency of the outstanding payment.

This type of skill is unique to Darcey Quigley & Co, and we confidently uncover the right contacts to recover from every day.

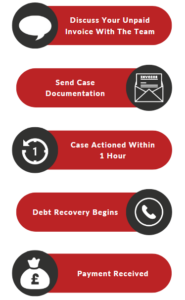

Our process follows a telephone debt recovery structure, reaching out to debtors repeatedly across all social media channels as well as WhatsApp and phone. This process has a 93% success rate in retrieving unpaid invoices.

Outcome:

Thanks to our assertive yet professional approach, the PLC engaged with us quickly. We negotiated a resolution and successfully secured full payment of the six-figure debt within just 2 business days of taking on the case.

Conclusion:

This case is a prime example of how Darcey Quigley can deliver rapid and effective results even against high-profile, well-resourced debtors. Our approach combines expert insight, innovative tools, and determination to ensure our clients get paid—fast.

If you have outstanding invoices, please don’t hesitate to get in touch with our friendly team of commercial debt experts today on 01698 821 468 or schedule a call for a time that suits you.

Lynne is the Founder and CEO of Darcey Quigley & Co.

She is passionate and determined to help businesses get overdue invoices paid quickly.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 17 years, Lynne has helped businesses recover commercial debts from every continent across the globe.

Connect with me on LinkedIn!