£3.5k Debt Paid Just Weeks Before Insolvency

Amount Due: £3.5k

Days Overdue: 487

Time to Recover: 72 hours

In the world of commercial debt recovery, success stories often go beyond just retrieving overdue payments. They showcase the crucial role that professional debt recovery agencies like Darcey Quigley play in protecting businesses from financial risks. In this blog post, we’ll delve into a recent case study where we successfully handled a complex debt situation for a client, demonstrating our expertise and commitment to securing positive outcomes for our clients.

In August, a small construction business approached Darcey Quigley with a £3,500 debt that was over 16 months old. The client had faced endless frustrations dealing with the debtor, who had been evasive and uncooperative, providing false promises of payment, and then disappearing without settling the outstanding amount. This ordeal had dragged on for well over a year, causing stress and financial strain for the client.

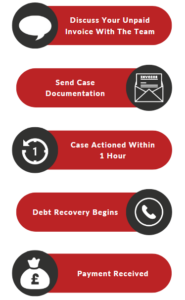

Upon receiving the client’s case, we swiftly took action to address the outstanding debt. Despite the debtor’s history of avoiding payment and causing delays, our experienced team deployed effective debt recovery strategies with precision and determination. Our process follows a telephone debt recovery structure, reaching out to debtors persistently across all social media channels as well as WhatsApp and phone. This process has a 93% success rate in retrieving unpaid invoices!

Within an impressive timeframe of 72 hours, we managed to secure full payment of the £3,500 debt, alongside late payment charges, much to the delight and relief of the client.

Just two weeks after we successfully recovered the debt for the client, the debtor company unexpectedly went into administration. This shocking turn of events highlighted the significance of timely and efficient debt recovery efforts, as the client had managed to recover the owed funds before facing potential loss due to the debtor’s insolvency.

The case study involving our swift and effective debt recovery intervention serves as a valuable lesson for businesses dealing with overdue payments. By engaging professional debt recovery services, businesses can navigate challenging situations, protect their financial interests, and mitigate risks associated with non-payment or insolvency.

If you have outstanding invoices please don’t hesitate to get in touch with our friendly team of commercial debt experts today on 01698 821 468 or schedule a call for a time that suits you.

Lynne is the Founder and CEO of Darcey Quigley & Co.

She is passionate and determined to help businesses get overdue invoices paid quickly.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 18 years, Lynne has helped businesses recover commercial debts from every continent across the globe.

Connect with me on LinkedIn!