Business Debt Recovery Frequently Asked Questions

Having to contact a business debt recovery specialist for the first time can be daunting for many businesses.

The pressure unpaid invoices place on businesses is huge with 440,000 businesses at risk of going bust due to the late payment crisis crippling UK firms, leaving many with no choice but to seek help with business debt recovery.

However, there are some misconceptions about the services we offer here at Darcey Quigley & Co.

We’ve answered the most frequently asked questions we hear about business debt recovery!

1. What is business debt recovery?

Business debt recovery, or b2b debt recovery, is the process of collecting unpaid debts owed by businesses to other businesses.

It involves thorough investigation of a case including gathering relevant documentation such as invoices and statements with the use of various strategies and techniques, such as negotiation, to recover overdue amounts efficiently.

2. How does business debt recovery work?

The process of business debt recovery starts with identifying the debtor and determining the amount of the debt owed.

Once the debt is verified having analysed the relevant documents, the creditor may choose to negotiate a repayment plan directly with the debtor or seek the assistance of a business debt collection agency.

3. What are the benefits of business debt recovery?

Business debt recovery provides several benefits, including the recovery of unpaid debts, improved cash flow, reduced financial strain, and the ability to focus on core business activities.

The recovery of unpaid debts and the financial benefits that come with it may be self-explanatory but you should never underestimate the benefits of freeing up time for your business to focus on other areas to grow and thrive.

Who has time to chase payments that should have already been made? Businesses are busy enough as it is!

It also helps businesses maintain their reputation by ensuring that they are paid for the goods and services they have provided.

4. What are the common reasons for business debt recovery?

The most common reasons for business debt recovery include non-payment of invoices, breach of contract, insolvency, bankruptcy, and fraud.

These issues can lead to financial losses for businesses, which is why it is important to have a solid debt recovery plan in place.

In many cases, the chances of recovering businesses debts from an insolvent company are extremely slim. This is why it’s critical to act quickly when you have overdue amounts owed and highlights the importance of effective credit control.

5. What is late payment interest and compensation?

Thanks to The Late Payment of Commercial Debts Act businesses have a legal right to add late payment interest and compensation on top of their outstanding amount.

Thanks to this law you can also claim reasonable costs for debt recovery, meaning you can get business debt recovery services free of charge!

6. How do I claim late payment interest and compensation?

Use our free calculator and find out exactly how much late payment interest, compensation and business debt recovery costs you can claim on your overdue invoices!

When you action a case with Darcey Quigley & Co we always strive to recover these from your debtor in addition to your full overdue amount, and we have a 94% success rate recovering these additional costs for our clients.

7. What are the consequences of not paying commercial debts?

Failing to pay commercial debts can result in serious consequences, such as legal action, damage to credit score, loss of business reputation, and reduced access to credit.

It is important for businesses to prioritise paying their debts to avoid these negative outcomes.

8. How long does business debt recovery take?

The time it takes to recover commercial debts varies depending on several factors, such as the size of the debt, the debtor’s willingness to pay, and the debt collection strategy used.

In some cases, debt recovery can be completed within a few weeks, while in others, it may take several months or even years.

However, the power of outsourcing can result in payment being made as soon as Darcey Quigley & Co get in contact.

On average we recover business debts within 16 days of a case being actioned, this is 5x quicker than a solicitor!

9. What are the costs associated with business debt recovery?

The costs associated with business debt recovery vary depending on the debt collection strategy used and specific criteria regarding the debt such as the age of the oldest overdue invoice, debt value, country your debtor is located in and whether the debt is disputed.

Our fees start from just 3%. Get a free quote and find out how much it will cost to recover your business debt.

10. Can businesses recover debts from international clients?

Yes, businesses can recover debts from international clients. However, the process may be more complex and may require the assistance of legal professionals with expertise in international debt recovery.

We’ve been recovering debts from all over the world for the past 16 years, collecting business debts from every continent.

Find out more about our international commercial debt recovery service.

11. How can businesses prevent the need for business debt recovery?

Businesses can prevent the need for business debt recovery by implementing robust credit control processes.

This includes:

- Credit checking a business every time they place an order.

- Have a full understanding of your sales ledger, aged debtors and when your invoices are due to be paid.

- Be proactive sending payment reminders and late payment chasers.

- Having a plan in place to protect cashflow in the event of non-payment.

If this sounds like a lot of work that you don’t have time for, don’t worry! We’ve partnered with automated credit control platform Know-it.

Know-it automates the complete credit control process to help businesses mitigate credit risk, reduce debtor days and boost cashflow! Plus, it’s free to sign up!

Darcey Quigley & Co are the official debt recovery partner for Know-it.

Why choose Darcey Quigley & Co for your business debt recovery needs

- We operate on a no win, no fee basis.

- Cases actioned within 1 hour with 48 hour turnaround.

- 93% success rate recovering overdue invoices.

- Fees starting from just 3%.

- Recover late payment interest and compensation on your behalf with an 89% success rate recovering additional charges.

- UK & International coverage.

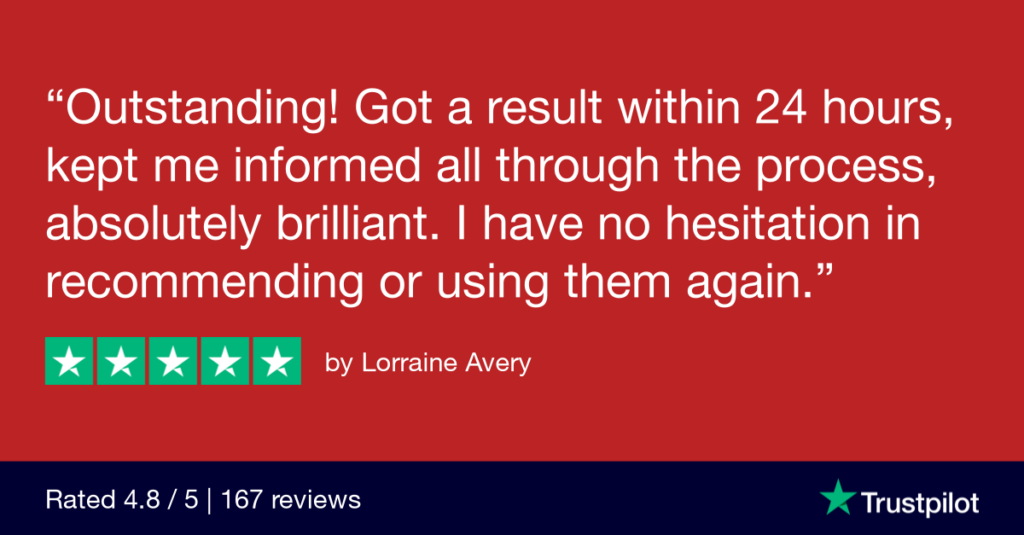

- Rated 5 Stars on Trustpilot.

If you have questions about a business debt schedule a call with one of our commercial debt specialists here or phone 01698 821 468.

Lynne is the Founder and CEO of Darcey Quigley & Co.

She is passionate and determined to help businesses get overdue invoices paid quickly.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 17 years, Lynne has helped businesses recover commercial debts from every continent across the globe.

Connect with me on LinkedIn!